Mark Ferguson seemed like a decent, thoughtful bloke who did good work as editor of LabourList, so I was disappointed when he announced he was going to work for Liz Kendall’s campaign. I was even more disappointed today when he went out of his way to (i) misrepresent the work of Keynes and (ii) appear to set the stage for Kendall’s campaign to fall into a gaping hole dug for them by George Osborne.

He said this today on Twitter…

I wonder how many people who think they’re Keynesians know that Keynes advocated running a surplus during periods of economic growth

— Mark Ferguson (@Markfergusonuk) June 12, 2015

and then linked to this older blog piece. I’m assuming that this signals thinking within Kendall’s campaign that suggests that they are looking to find a way to “neutralise” Osborne’s latest trap by falling straight into it.

Osborne’s new wheeze is to state that his future vision of the British economy is one in which it returns to “Victorian values” of constant budgetary surpluses. That this ignores the staggeringly obvious fact that Britain’s Victorian surpluses were based on vast incomes from empire is only the smallest part of the stupidity of Osborne’s position.

Let’s start by making clear that Ferguson is fundamentally wrong about Keynes. Keynes was not in favour of running up surpluses for the sake of it, even in periods of economic growth. It is true that some modern neo-Keynesians make this case, but it was not Keynes’s position. In his General Theory Keynes said:

“We must also take account of the effect on the aggregate propensity to consume of Government sinking funds for the discharge of debt paid for out of ordinary taxation. For these represent a species of corporate saving, so that a policy of substantial sinking funds must be regarded in given circumstances as reducing the propensity to consume. It is for this reason that a change-over from a policy of Government borrowing to the opposite policy of providing sinking funds (or vice versa) is capable of causing a severe contraction (or marked expansion) of effective demand.”

Sinking funds (government surpluses) take money out of the economy, reduce demand and slow growth. Storing up cash for a rainy day actually increases the risk of rain. For Keynes, government surpluses might be considered if, and only if, they were consistent with his core concern – full employment – to create a balanced budget over the course of a budgetary cycle. But, and this is crucial, this is not the same as advocating some sort of rigid fiscal rule and, in any case, with a mix of high rates of underemployment, stagnant or declining real wages and unemployment still running at almost 5.5%, the current UK economy is some way from meeting Keynes’s condition to support government surpluses.

Even if we assumed, for a moment, that Keynes did say that we should run up surpluses in good times. We are most certainly not living in good times.

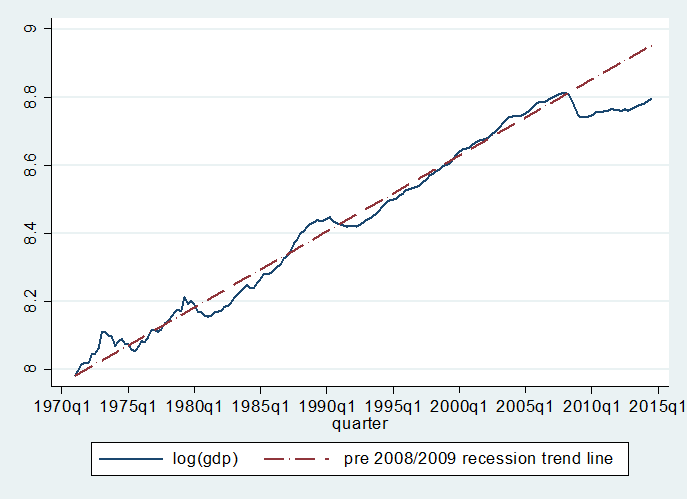

Take a look at the gap between the size of the UK’s economy and where it should be if we had got back on trend. And look back at the difference between what has happened to the UK economy in this economic disaster compared to what happened in the (admittedly smaller but still significant) economic shocks of the early 1980s and 1990s. The reason why the British economy has not bounced back towards trend is almost entirely because of this government’s perverse and ongoing commitment to austerity.

The human impact of this failure is public and private immiseration. Underemployment and low wage growth matched with the destruction of basic provisions of the welfare state.

The impact of Osborne’s commitment to long-term surpluses will be to prevent the investment necessary now to get the economy back towards its pre-crash potential. You can bet that Osborne’s plans of achieving surpluses during times of growth don’t involve matching necessary spending with increases in tax income. He, and I think Ferguson – certainly many Blairites, assume that surpluses will be achieved by cuts in spending. It is a vision of perpetual austerity.

The truth is that, for the foreseeable future, getting the UK economy back on track is going to require the support of government deficits, even if the economy is growing. This is not a reckless policy and it should be maintained until we get somewhere close to the full capacity of the economy – only then might there be a meaningful case for introducing some restraints on public spending, but that’s not guaranteed. Even the neo-Keynesian idea of a “counter-cyclical” government policy does not imply that there needs to be regular (nevermind permanent) budget surpluses in stronger economic times. Nor is this a vision of permanent, increasing national debt. I’ve argued before that the way that nations repay debt is not through cutting current spending, it is best achieved through sustainable growth and a period of modest inflation.

All this makes it more depressing that a part of the Labour movement wants to embrace Osborne’s goal and that they are enlisting Keynes (either through misunderstanding or deliberate misrepresentation) to support this view is enraging. There is no serious economic case for budget surpluses in Britain right now, and certainly no Keynesian case for the pursuit of permanent austerity.

For me the focus of government policy should not be on arbitrary economic rules but on the outcomes for its people. Right now what Britain needs more than anything is economic growth that is widely and fairly distributed amongst all its citizens. Osborne’s Victorian mirage will stop us achieving that and it will further punish those who have already paid too much for his pursuit of austerity regardless of its impact on poverty.

And that should be obvious to everybody in the Labour Party.

Leave a Reply