So I was reading a story submitted by an author in a writing group I belong to and he’d decided to write a story with a political background. It was supposed to be set in the future but he couldn’t resist dropping in one of those slightly ranting asides about the present state of the nation that are the punji-stake-floored trap that skewer so many writers who decide to have a stab at writing explicitly about politics. These traps are particularly deadly if your understanding of the political situation is drawn only from the soul-sucking, half-witted jabbering that passes for political debate on our national media.

So, what was the trap my colleague fell into? Well I’m not going to quote him directly, but it went a bit like this – the story is set about twenty years in the future and a character is monologuing to himself:

“Prime Minister Harlow’s honeymoon with the electorate hadn’t lasted long. The emergency budget, just three months into his term of office, had seen to that. Not that he had any choice. Anyone in his position would have had to do something about the ballooning deficit – the global markets didn’t leave any room for manoeuvre.

“Harlow measures were modest, but while the British public might have sworn blind to the pollsters that they wanted someone to come in and sort out the economy, sd soon as Harlow had raised taxes a little and cut spending a bit they’d turned on him like a pack of wild dogs.

The public wanted the mess sorted out alright, but only if they, personally, didn’t have to give anything up to pay for it.”

Now my colleague is hardly alone in this assessment of the British public or, indeed, the analysis of the fundamental weakness of modern social-democratic economies. (And I don’t want to sound like I’m insulting him or calling him stupid – I’m not. I think he’s wrong but this the “common sense” opinion of many economists and politicians – it’s part genuinely held political opinion by those who tend towards doom-mongering and part highly effective propaganda distributed by those who want to railroad us down their chosen path to “economic salvation”.) In particular it has been refined by the UK’s current government to justify their policies – it goes (somewhat crudely stated) like this:

“Economies are in crisis, dramatic action is needed or disaster awaits but our political systems can’t deliver it. If we don’t cut the public sector to shreds, we’ll all end up like Greece but the bleeding-hearts are too cowardly and the public too venal. Someone has to take the tough choices for the good of us all!”

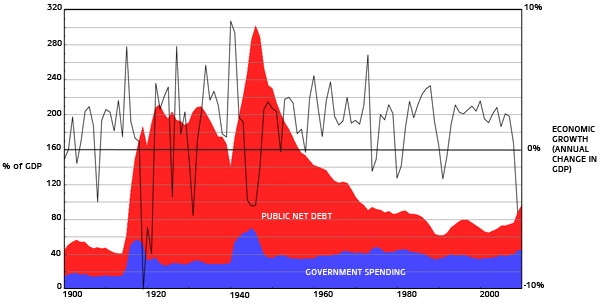

The “debt crisis” has become the foundation of every ConDem justification for the shredding of the public sector. But, while the sharp up-turn in Britain’s levels of debt is something that needs to be dealt with, a quick look at the chart below reveals a number of interesting facts.

- See that red area? That’s Britain’s national debt since 1900 compared to the country’s annual income (or Gross Domestic Product – GDP) measured on the scale on the left. There are two interesting things about that red area. First far from the political system being unable to manage to repay debt, the history of British economic policy since 1945 may be seen as the long, successful battle to bring down the debt of a nation crippled by two world wars separated by fifteen years of unprecedented global economic crisis. When Gordon Brown’s as Chancellor made the decision to pay off a big chunk of Britain’s debt the burden had fallen to levels rarely seen since before the Great Depression of the 1920s.The second point to note is that while the current generation of politicians go on about our debt levels as though they were a burden that will inevitably wreck our economy they are as nothing compared to the debts Britain carried in the post-war period when – from 1945 to the early 1970s it enjoyed a period of high growth, steadily improving incomes for its citizens and built a welfare state.

- See that blue area? That’s the amount of the country’s annual income that is spent by the government each year, it’s also measured by the scale on the left. The important point here is that while British public sector spending has risen since 1900 (in two major steps, the first after WWI and the second after WWII) it has (since the 1950s) been relatively stable at around 40% of the economy. Sometimes it creeps a bit higher (usually when the country experiences an economic downturn and costs for the government go up while incomes from taxes go down) and sometimes it slides down a little (usually during periods of strong growth). Despite the heated debates amongst politicians, repeated government claims to be slashing costs or cutting waste don’t tend to have much effect. In years before the bottom started to fall out of the British (and world) economy in the late 2000s, public sector spending wasn’t out of control or even particularly high by historic standards. It was slightly below 40% which, given that the economy had enjoyed a decade of robust growth under Brown’s chancellorship, is where we’d have expected it to be.

- Finally, there’s the black line. That’s the percentage change in the GDP each year since 1900 (it’s measured by the scale on the right – it stops in 2009, slightly before the other two that go up to 2010). It’s a measure of whether the economy is growing or shrinking. I want to make two points here. First, the scale of the economic mess we ended up in at the end of the 00s is not trivial. It’s the worst since the economic crises of the 1930s and is surpassed only by the economic collapse that sparked the Great Depression. It knocks into a cocked- hat the minor difficulties (!) of the oil crisis of the 1970s and the twin disasters of the Thatcher/Major years. The second point to note is the correlation between changes in growth of the economy and the level of debt. WWI drove British debt higher in the 1910s but it was the economic crises of the 1920s and 1930s that kept it high. WWII drove debt to new peaks, but sustained economic growth allowed repayment. The fall in the level of debt stalled with the economy in the oil crisis in the 1970s and the mistakes of the 1980s. Debt repayment picked up during the “Lawson boom” only to falter in the “Lamont Bust”. Brown’s decade of steady growth from 1997 saw debt kept at relatively low levels before it started to spike again with the banking crisis.

So what does all this tell us?

Well, first it tells us that the political system is perfectly capable of delivering policies that reduce debt. We are neither helpless spectators nor venal contributors to economic disasters caused by debt.

Second, while our current levels of debt do need to be controlled, the historical evidence demonstrates that we did sustain similar (and much higher) levels of debt in the past and probably still could, if we had to. Britain has never been on the verge of becoming another Greece or Portugal or Ireland (God save her!) – this is not a “debt crisis”, it’s much more of a “debt potential threat if we don’t do something quite soon situation”.

Third, it suggests that in normal circumstances (i.e. outside global wars with Germany and her allies) British government spending has relatively little relationship to the level of debt. British public sector spending has been more-or-less steady as a proportion of the national income since 1945 and debt has fallen (and risen) again regardless.

And finally, it tells us quite clearly that if your goal is, genuinely, to cut debt (rather than to use debt as a screen to hide ideological attacks on the size of the state) then your economic policy should be built around the pursuit of economic growth. British history since 1900 shows that real debt reduction only takes place during times of strong and sustained economic growth.

Now no doubt you’re thinking that I’ve taken an aside in a short story a bit too seriously. And maybe I have, but the problem with expressions of the “common sense” view of politics or economics is that it so consistently favours the forces of reaction and retreat. It has become “common sense” not because it accurately reflects our world but because it serves a purpose. It needs to be challenged and exposed. So I did.